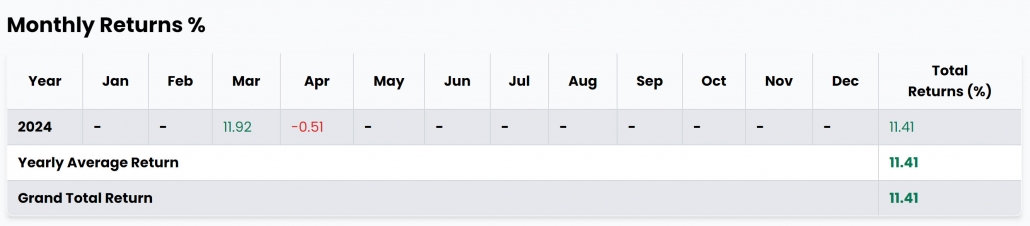

Performance Results of Pentagon Guider Mar 2024:

Virtual Trading of Weekly Stock Portfolio Idea for RM50,000

In the rapidly changing landscape of stock trading, virtual trading competitions provide a unique and valuable platform for traders to test strategies without financial risk. One such competition, the Series 3: QuickTrade (Short Term) Trading Fund, showcased a remarkable performance from March to April 2024 under the guidance of Martin TF Wong, using the innovative Pentagon Guider system. This article delves into the trading results of this period, where a starting portfolio of RM 50,000 saw a net gain of 11.41%.

Overview of the Trading Strategy

Martin TF Wong, our speaker, co-founder entered the virtual competition with a strategy focused on short-term trades informed by the Pentagon Guider—a system that identifies potential buy and sell signals based on market volume dynamics.

- Specifically, Martin’s VSA strategy relied on visual confirmation of a Green Pentagon, which is a buy signal, prompting him to enter the trade at the opening price of the next bar or at the close price of the bar displaying the Green Pentagon.

- Over the course of two months, Martin engaged in 9 trades, of which 6 were profitable, reflecting a win rate of 66.67%. The strategy led to a maximum portfolio increase to RM 55,705, demonstrating a meticulous balance of risk and reward with a maximum drawdown of just 0.5%.

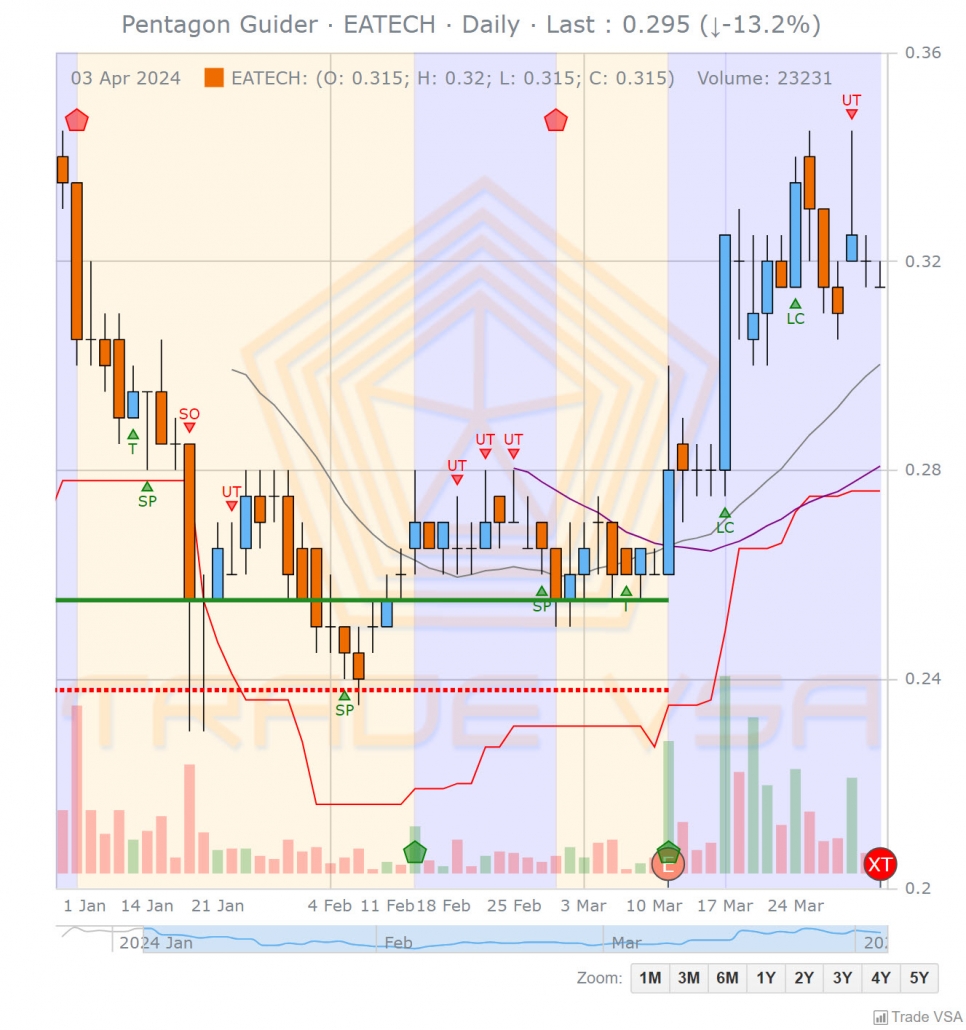

Trade Performance Highlights

- EATECH: A standout trade where Martin followed the Green Pentagon signal, entering at RM 0.280 and exiting at RM 0.320, yielding a profit of RM 1,428 (14.29%).

- RAMSSOL: This trade followed a Green Pentagon entry at RM 0.410 and an exit at RM 0.445, resulting in a profit of RM 854 (8.54%).

- SIMEPROP: Another successful application of the Pentagon Guider, with a purchase at RM 0.810 and a sell at RM 0.920, bringing in RM 1,353 (13.58%).

- RSAWIT: The highest profit from a single stock, Rimbunan Sawit Bhd, with a return of RM 1,487.50 (14.89%) from an opening price of RM 0.235 to a closing of RM 0.270 following a Green Pentagon signal.

- SCGBHD: Bought at RM 0.510 and sold at RM 0.555 after a Green Pentagon signal, this trade netted a profit of RM 886.50 (8.82%).

The strategy also accounted for losses, with the most significant being from Leong Hup International Bhd (LHI), which saw a reduction in portfolio value by RM 253.50.

Monthly Performance and Analysis

The equity curve started with a strong uptick in March with an 11.92% return, followed by a slight dip in April of -0.51%. This minor decline can be attributed to a few non-profitable trades and possibly market volatility, which is typical in short-term trading scenarios.

Educational and Strategic Takeaways

The performance of Martin’s portfolio in the virtual trading competition serves as an excellent case study for traders aiming to refine their strategies. The key takeaways include:

- Effective Entry and Exit using Pentagon Guider System: Timely decisions are crucial, as seen in the profitable trades that significantly outweighed the losses.

- Risk Management: Fixed position size and value per trade, keeping drawdowns low and managing non-profitable trades effectively helped in maintaining overall portfolio health of RM50k

- Leveraging VSA Algorithm Pentagon Guider Technology: Utilizing advanced tools like the Pentagon Guider can provide critical insights and enhance trading decisions.

Conclusion

The virtual trading performance of the Pentagon Guider from March to April 2024 provides valuable lessons on the effectiveness of technical analysis tools in stock trading. Whatsapp 010-266-9761 on how you can benefit from our speaker weekly stock trade idea.

Disclaimer : Past performance is not indicative of future results. Trading involves risks, including the potential loss of principal, as market conditions can fluctuate significantly. Always consider your investment objectives and consult with a financial advisor prior to trading.

Insider buying in Bursa Malaysia

Insider buying in Bursa Malaysia refers to the purchase of shares of a company’s stock by its executives, officers, directors, or other insiders who have access to confidential information about the company. Insider buying is considered to be a bullish sign for a company’s stock, as it indicates that the insiders have confidence in the company’s future prospects and believe that the stock is undervalued. From our TradeVSA research we have seen directors like Tan Sri Vincent Tan Chee Yioun, Tan Sri Lim Wee Chai taking considerable stakes in their own company after disclosing as per regulation CA2016.

In Bursa Malaysia, insider buying is regulated by the Malaysian Securities Commission (SC) and is governed by the Securities Commission Act 1993 and the Code of Corporate Governance. According to the SC, insiders are required to report their dealings in the company’s securities within five days of the transaction. This information is then made publicly available, providing transparency and helping to prevent insider trading.

Here are some the performance likely for these insider buying in KLSE.

- Increased demand will lead to higher prices in futures

- Improved market sentiment by director dealing can improve investor sentiment

- Improved financial performance gives the business owner, stakeholders to take fresh position in their company

How to find them eg. insider buying in Bursa Malaysia.

You can find information about insider buying in Bursa Malaysia by accessing the Bursa Malaysia website. Here are the steps you can follow:

- Go to the Bursa Malaysia website (https://www.bursamalaysia.com/).

- Click on “Market Data” and then “Insider Trades”.

- You will be directed to the Insider Trades page where you can find information about insider buying and selling of securities.

- On this page, you can view the latest insider trades by selecting the date range and security you are interested in.

- The Insider Trades page will show you the insider transactions, including the name of the insider, the security name, the volume of shares bought or sold, and the price per share.

Alternatively, using VSA360 dashboard, you can scan the latest filing by insider buying using TradeVSA special screener. Here is an example of the screen results.

| Stock | Date Change | Name | Unit | Mkt Cap | Industry | Value(RM) | ||

|---|---|---|---|---|---|---|---|---|

| 2023-02-07 | Pavilion Access Sdn Bhd | 99.6 M | 157.4 M | Industrial Products & Services | 38.9 M | |||

| 2023-02-07 | Mr Wong Thean Soon | 5 M | 6.7 B | Technology | 3.5 M | |||

| 2023-02-07 | Inodes Limited | 4.9 M | 3.5 B | Technology | 7.1 M | |||

| 2023-02-07 | Creador Ii, Llc | 4.9 M | 3.5 B | Technology | 7.1 M | |||

| 2023-02-07 | Chow Zee Neng | 1.1 M | 157.4 M | Industrial Products & Services | 447.4 |

It is important to note that while insider buying can be a positive sign, it is not a guarantee of future performance. Other factors, such as market conditions and the company’s financial performance, also play a significant role in determining a stock’s future performance. As such, it is recommended to consider insider buying as one of many factors when evaluating a stock investment in Bursa Malaysia.

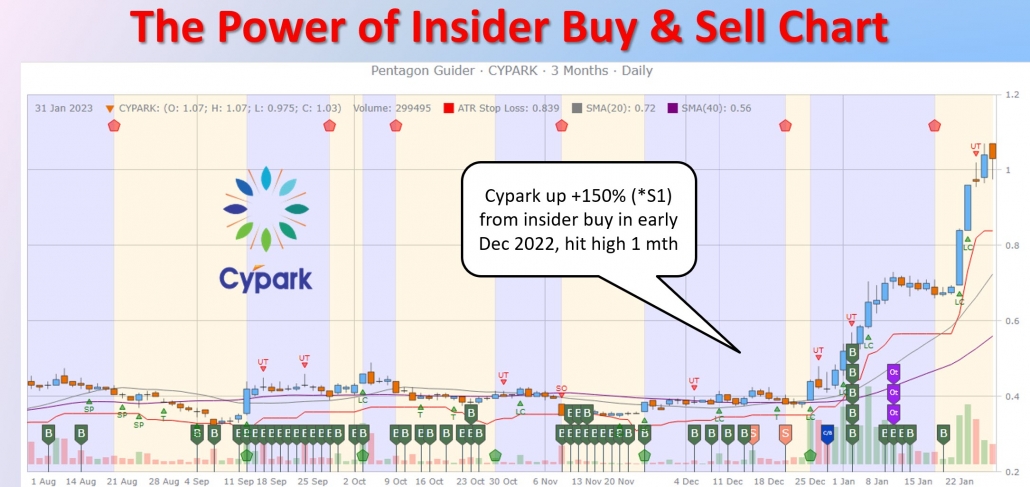

VSA360 also details the filing by insider buying in KLSE using TradeVSA buying and selling guide chart which we believe every trader and investors should have access to them.

The Power of Insider Buy & Sell Chart

To sign up for free 10 days worth RM288 to TradeVSA Dashboard and Insider Buying and selling guide chart, click here.

Or goto https://tradevsa.com/tradevsa-demo-account/

TradeVSA System Sdn Bhd. is the 1st Financial Technology Company that focuses on Volume Spread Analysis analytics. Volume Spread Analysis (VSA Malaysia) is a unique trading methodology well known among professional traders/investors in the West and becoming popular in Asia now.

TradeVSA’s mission is to help every traders/investors to “TRADE SMARTER EVERY TIME” and bring clarity with easier understanding of the financial stock market complexity with VSA Malaysia.

TradeVSA has been awarded Malaysia Digital status on 28 November 2023.

Address

Unit A-16-13, Block A, 16th Floor,

Tropicana Avenue, Persiaran Tropicana,

47410 Petaling Jaya, Selangor, Malaysia

Email

support@tradevsa.com

Contact

+60-10-266-9761