Dagang Nexchange: DNEX correcting now, Is this time to buy now?

By leveraging its wealth of knowledge and expertise, Dagang NeXchange Berhad (KLSE: DNEX) has become a leading provider of eServices focused on trade facilitation, system integration and consultancy. By supplying customized services, solutions and infrastructures, the company is positioning itself as a reputable player in a myriad of sectors including the lucrative IT, Technology and most recently – the energy industry.

The company has been making several growth strides in the past months to facilitate its progress. DNEX is focusing its efforts on adding prominent key personnel to its BOD to facilitate its new ventures into the lucrative oil and gas industry. Additionally, the company’s previous acquisition of Silterra will enable the company to position itself as an emerging leader in the growing semiconductor industry. In fact, the subsidiary has recently announced a $645 million investment on an expansion plan that will result in a 20% increase in its annual capacity.

On February 16, DNEX was among the most actively traded stocks and traded at its record high of RM1.27. In light of the company’s constant development and expansion efforts, investors are bullish DNEX could reach new highs in the coming months.

Lets’ look at

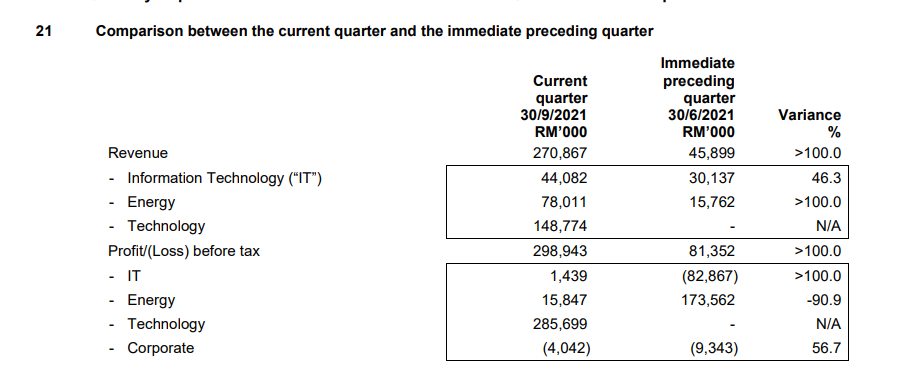

Company Latest Quarter results

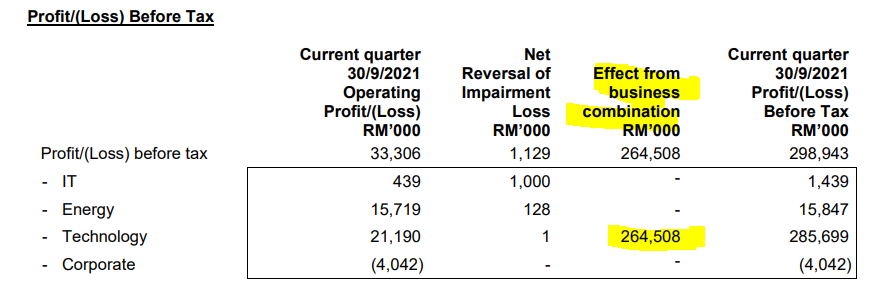

The company reported RM 270 million in quarterly revenue, up from RM 45 million in the previous quarters.This represents a 490% QoQ increase in revenue. The main reason behind the surge in revenue is mainly due to the acquisition of SilTerra Malaysia Sdn Bhd from Khazanah Negara, which is a semiconductor wafer foundry.

The increase in revenue from RM 15 million to RM 78 million, representing a 396% QoQ growth rate, is also due to the company’s recent acquisition due to the consolidation of Ping results (RM67.27 million) in the current quarter, as well as the impact of the recent improvement in oil price.If we remove the acquisition of Ping, the company’s revenue for its energy segments only posted a revenue of RM 11 million, which is actually declining.

Thus, most of the 490% QoQ growth in revenue from DNEX has come from inorganic growth, where the company increased its revenue through the acquisition of another company. However, one of the positives is that the company’s IT segment increased its revenue by 46% QoQ from RM 30 million to RM 40 million in the latest quarters.

The quarterly trend for DNEX were impressive as ever as you can see QtoQ jump so far.

Source: TradeVSA TradingView

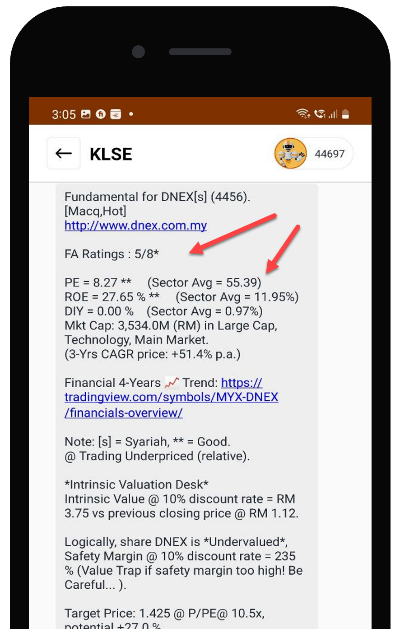

DNEX, Looking a low PE now ? Is this really “cheap” ?

Source: SMARTRobie (Available from Google Playstore and Apple Playstore)

In term of fundamental standpoint, even the company is trading at a PE ratio of 8.27 which look cheap but if we took a deeper dive the company EPS is actually boosted due to its recent acquisition of the semiconductor company from Khazanah. The boost in EPS is only one time and unlikely to sustain. Thus, the company underlying business is actually trading at a much higher valuation.

Technical Analysis from TradeVSA Weekly Chart

Longer term trend according to VSA (Volume Spread Analysis). Long period of re-accumulation spotted in the DNEX weekly chart since March 2021. In this re-accumulation we can notice how Smart Money plan this movement from the beginning before a breakout of +31% profit !

Based on the backtesting, a healthy trending stock will form reaccumulation. We will share with you similar case study in this article shortly.

So, what is Re-Accumulation ?

A Reaccumulation is the process of Absorbing shares during an uptrend. It is a pause in a major uptrend that can take weeks to months (sometimes years) to complete. It serves the same purpose as an Accumulation. By the way, we are holding our VSA/Wyckoff conference Mar 12, 2022. Check us out there https://bit.ly/3vaUCR4

In this stage, you will notice several Shakeout will happen as Smart Money trying to remove weakhand-holders before breakout.

Here is the previous review for DNEX in reaccumulation

Below is another re-accumulation stock, TAANN, with +65% profit !

Reaccumulation is always needed to ensure the trend overall is still healthy. In the next few articles, we will go into details and break down what is happening in Re-Accumulation and how you can spot like a Smart Money too!

With this, you can Trader Smarter Everytime and avoid trap by Smart Money

Join our Telegram Channel and we will share more VSA techniques with you.

https://t.me/tradevsatradingideas

Disclaimer

This information only serves as reference information and does not constitute a buy or sell call. Conduct your own research and assessment before deciding to buy or sell any stock