Performance Results of Pentagon Guider Mar 2024:

Virtual Trading of Weekly Stock Portfolio Idea for RM50,000

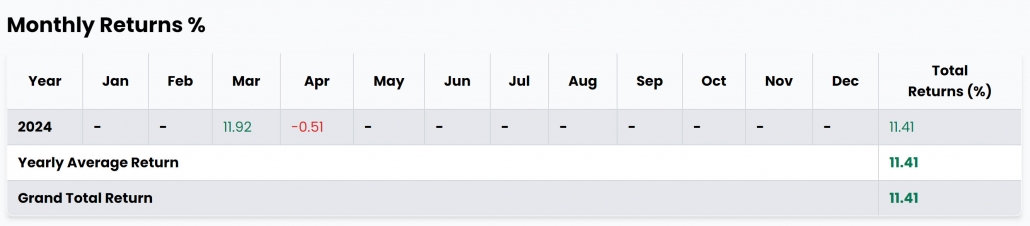

In the rapidly changing landscape of stock trading, virtual trading competitions provide a unique and valuable platform for traders to test strategies without financial risk. One such competition, the Series 3: QuickTrade (Short Term) Trading Fund, showcased a remarkable performance from March to April 2024 under the guidance of Martin TF Wong, using the innovative Pentagon Guider system. This article delves into the trading results of this period, where a starting portfolio of RM 50,000 saw a net gain of 11.41%.

Overview of the Trading Strategy

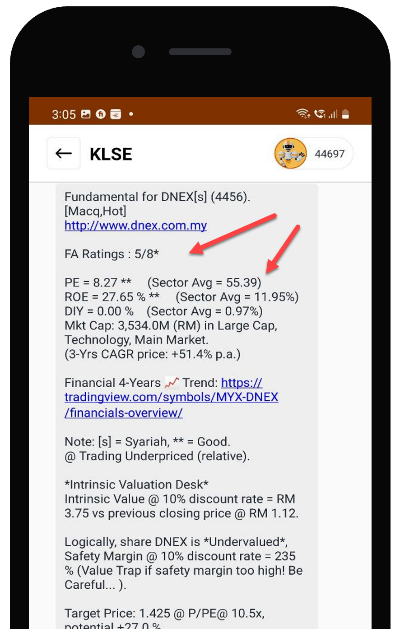

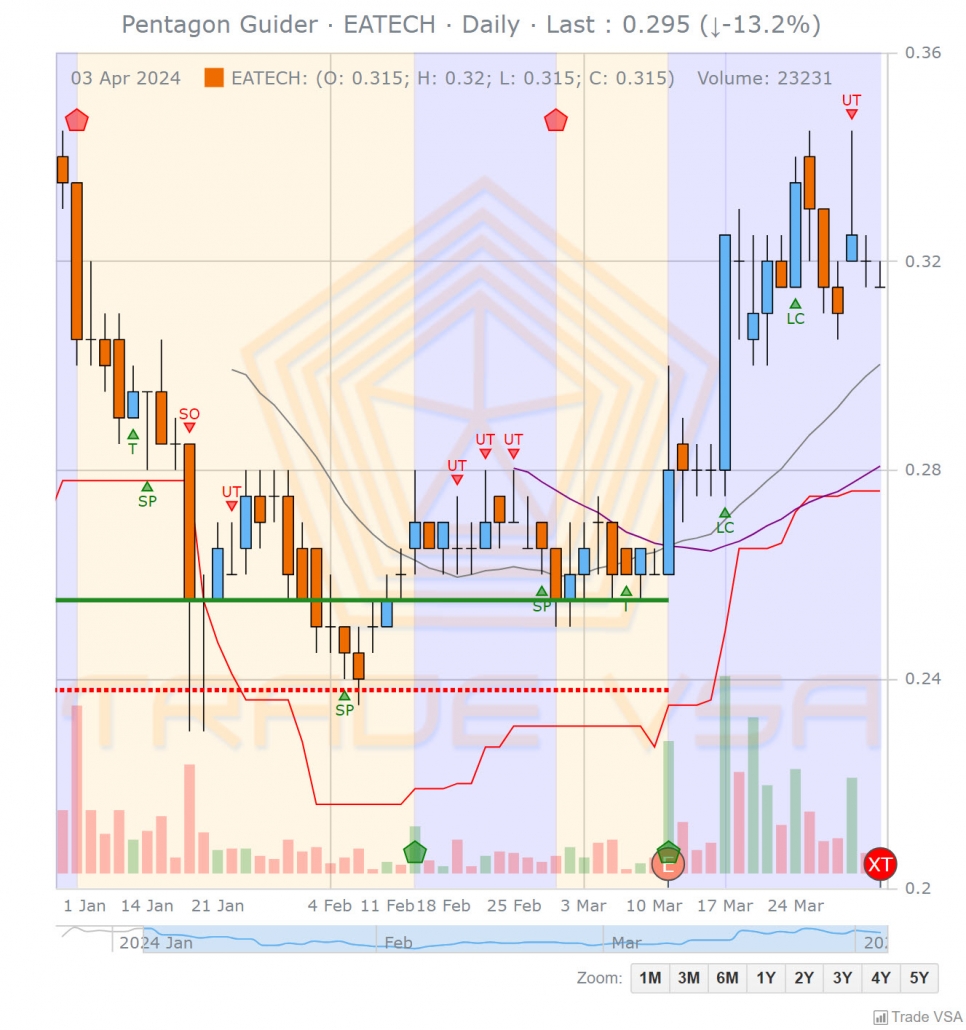

Martin TF Wong, our speaker, co-founder entered the virtual competition with a strategy focused on short-term trades informed by the Pentagon Guider—a system that identifies potential buy and sell signals based on market volume dynamics.

- Specifically, Martin’s VSA strategy relied on visual confirmation of a Green Pentagon, which is a buy signal, prompting him to enter the trade at the opening price of the next bar or at the close price of the bar displaying the Green Pentagon.

- Over the course of two months, Martin engaged in 9 trades, of which 6 were profitable, reflecting a win rate of 66.67%. The strategy led to a maximum portfolio increase to RM 55,705, demonstrating a meticulous balance of risk and reward with a maximum drawdown of just 0.5%.

Trade Performance Highlights

- EATECH: A standout trade where Martin followed the Green Pentagon signal, entering at RM 0.280 and exiting at RM 0.320, yielding a profit of RM 1,428 (14.29%).

- RAMSSOL: This trade followed a Green Pentagon entry at RM 0.410 and an exit at RM 0.445, resulting in a profit of RM 854 (8.54%).

- SIMEPROP: Another successful application of the Pentagon Guider, with a purchase at RM 0.810 and a sell at RM 0.920, bringing in RM 1,353 (13.58%).

- RSAWIT: The highest profit from a single stock, Rimbunan Sawit Bhd, with a return of RM 1,487.50 (14.89%) from an opening price of RM 0.235 to a closing of RM 0.270 following a Green Pentagon signal.

- SCGBHD: Bought at RM 0.510 and sold at RM 0.555 after a Green Pentagon signal, this trade netted a profit of RM 886.50 (8.82%).

The strategy also accounted for losses, with the most significant being from Leong Hup International Bhd (LHI), which saw a reduction in portfolio value by RM 253.50.

Monthly Performance and Analysis

The equity curve started with a strong uptick in March with an 11.92% return, followed by a slight dip in April of -0.51%. This minor decline can be attributed to a few non-profitable trades and possibly market volatility, which is typical in short-term trading scenarios.

Educational and Strategic Takeaways

The performance of Martin’s portfolio in the virtual trading competition serves as an excellent case study for traders aiming to refine their strategies. The key takeaways include:

- Effective Entry and Exit using Pentagon Guider System: Timely decisions are crucial, as seen in the profitable trades that significantly outweighed the losses.

- Risk Management: Fixed position size and value per trade, keeping drawdowns low and managing non-profitable trades effectively helped in maintaining overall portfolio health of RM50k

- Leveraging VSA Algorithm Pentagon Guider Technology: Utilizing advanced tools like the Pentagon Guider can provide critical insights and enhance trading decisions.

Conclusion

The virtual trading performance of the Pentagon Guider from March to April 2024 provides valuable lessons on the effectiveness of technical analysis tools in stock trading. Whatsapp 010-266-9761 on how you can benefit from our speaker weekly stock trade idea.

Disclaimer : Past performance is not indicative of future results. Trading involves risks, including the potential loss of principal, as market conditions can fluctuate significantly. Always consider your investment objectives and consult with a financial advisor prior to trading.