Learn how AI can assist you in the stock market

Investing in the stock market can be a daunting task, especially for new investors who are unfamiliar with the technicalities and jargon involved. This is where conversational chatbots come in. With the evolution of ChatGPT technologies, conversational chatbots can now provide personalized advice and decision support to investors, making it easier for them to navigate the stock market.

ChatGPT technology uses natural language processing and machine learning algorithms to understand and generate human-like responses to various queries. This technology has now evolved into an intelligent conversational agent that can provide advice and decision support in various industries, including stock trading.

One of the key benefits of conversational chatbots in stock trading is their ability to provide real-time advice and support. By monitoring market movements and keeping investors up-to-date with the latest news and developments, the chatbot can help them make timely and informed decisions. This is particularly important in the fast-paced world of stock trading, where even a few seconds can make a significant difference.

To be effective, the chatbot must be trained on a wide range of financial data and have a deep understanding of market dynamics. This includes analyzing past market data, identifying trends, and providing actionable insights that can help investors make informed decisions. Additionally, the chatbot can be trained on news and social media data, which can provide valuable insights into market sentiment and help investors understand how news events may impact their investments.

Another key benefit of conversational chatbots in stock trading is that they can help investors overcome the cognitive biases that often lead to poor investment decisions. By providing a rational and data-driven perspective, the chatbot can help investors make decisions that are based on sound logic and analysis, rather than emotion or gut instinct.

However, there are also some challenges to developing a conversational chatbot that can provide effective investment advice. One of the biggest challenges is ensuring the accuracy and reliability of the chatbot’s recommendations. This requires a rigorous testing and validation process to ensure that the chatbot is making informed and reliable predictions.

This is evolution of conversational Chatbot in stock trading idea generation undertaken by TradeVSA System.

TradeVSA System, a prominent provider of stock trading analysis software in Malaysia, has recently launched a new app called SmartRobie, which promises to revolutionize the way traders generate trading ideas. SmartRobie combines advanced Volume Spread Analysis technical analysis techniques with AI chatbot to provide traders with timely and accurate trading trade ideas.

Above is a screenshot of the SMARTRobie app, Stock Market Assistant

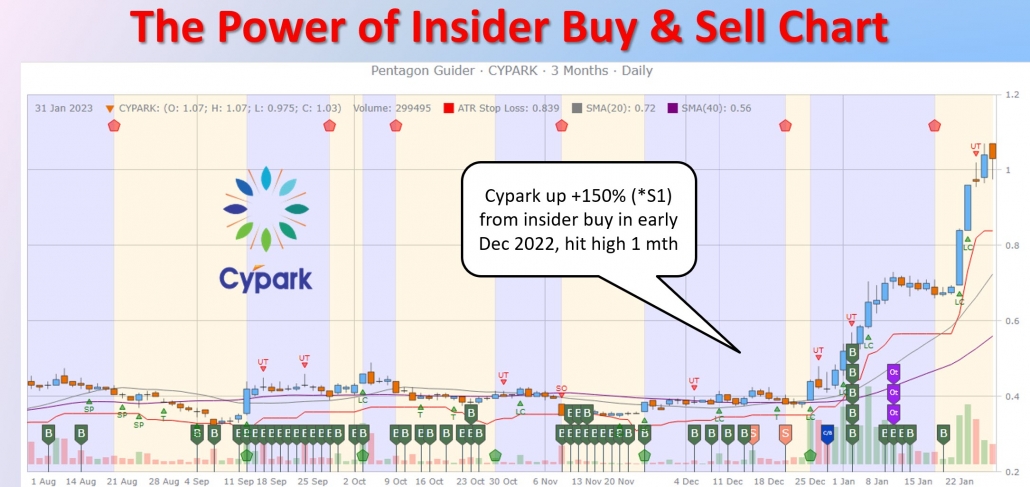

One of the key features of SmartRobie is its ability to analyze large amounts of data quickly and accurately. The app uses proprietary TradeVSA algorithms based on Volume Spread Analysis with Smart Money operating to scan the markets for potential trading opportunities, based on a wide range of technical indicators, including moving averages, trend lines, and momentum indicators. This means that traders can generate ideas in real-time, based on the latest market data.

SmartRobie is also designed to be user-friendly, with a simple and intuitive interface that makes it easy for traders to use. The app provides clear and concise TradeVSA Pentagon Guider charts and graphs that allow traders to visualize market trends and patterns, and to quickly identify potential entry and exit points.

In addition to its advanced analysis and user-friendly interface, SmartRobie website (https://tradevsa.com) also offers a range of educational resources and support for traders. The app includes a comprehensive library of educational videos, tutorials, and articles, as well as a dedicated support team that is available to answer any questions and provide guidance on how to use the app effectively.

Overall, SmartRobie app represents a significant step forward in the world of stock trading analysis. By combining cutting-edge technology with a user-friendly interface and personalized support, it has the potential to transform the way traders generate ideas and make investment decisions. Whether you are a seasoned professional or a novice trader, SmartRobie is definitely an app worth considering if you are looking to improve your trading results and take your skills to the next level.

Download a copy of SmartRobie from Google Playstore and Apple Store.