TradeVSA System Sdn. Bhd. Granted First Digital Investment Advice (DIA) License in Malaysia, Powered by TradeVSA ALGO Pentagon Guider® System

Kuala Lumpur, Malaysia – October 4, 2024 – TradeVSA System Sdn Bhd is proud to announce that it has become the first company in Malaysia to be granted a Digital Investment Advice (DIA) license by the Securities Commission (SC), based on the Technical Note No. 1/2022.

“It is a very stringent application as Company must demonstrate it has the necessary technological capabilities and governance structure including, but not limited to capacity and capability in formulation and implementation of effective algorithm tools in its undertaking of proposed DIA activities. And TradeVSA passed the test as it has proven capabilities of the company’s proprietary TradeVSA ALGO Pentagon Guider® System, which drives its digital investment advice platform for traders and investors,” said Rianne Chin, CEO of TradeVSA System Sdn Bhd.

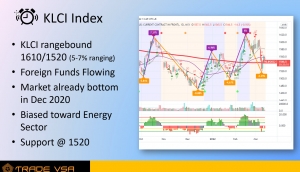

The TradeVSA ALGO Pentagon Guider® System is innovative AI-powered analytics that leverages Volume Spread Analysis (VSA) and smart money trading strategies to deliver real-time, actionable insights for traders/investors. This system is tailored for both retail and institutional traders/investors, enabling them to make informed decisions based on deep market analysis and historical data.

“Receiving the SC license is a monumental achievement for us and a testament to the power and reliability of our Pentagon Guider® System. We are excited to offer our traders/investors a state-of-the-art platform that puts them in control of their financial futures. User can experience the power of Pentagon Guider® System with our mobile application SMARTRobie® available in Apple Appstore and Google Play store now. SMARTRobie® currently covers Bursa, SGX, HKSE and S&P 500” said Rianne Chin, CEO of TradeVSA System Sdn Bhd.

“With the Securities Commission’s (DIA) license, our ALGO technology now provides traders/investors with professional-grade advice, driving financial growth through digital empowerment on the hands of Gen-Z/New Millennials.”

The TradeVSA ALGO Pentagon Guider® System analyses technical analysis market patterns based on time-proven Volume Spread Analysis (VSA) and presents users with clear guidance on entry and exit points indicated with Green and Red Pentagon on the chart. Its capabilities allow traders/investors to react swiftly to market changes while receiving data-driven advice, previously accessible only to institutional traders/investors.

This approval from the SC is not only a recognition of TradeVSA’s technological leadership but also a milestone for the Malaysian fintech ecosystem. With the licensed Pentagon Guider® System, the company is poised to support a growing community of traders/investors by offering digital-first solutions for smarter investment decisions.

For more information about TradeVSA System Sdn Bhd and its services, please visit [www.tradevsa.com](http://www.tradevsa.com).

About TradeVSA System Sdn. Bhd.:

TradeVSA System Sdn Bhd is a leading fintech company specializing in Volume Spread Analysis (VSA) and smart money strategies. With its innovative Pentagon Guider® System, TradeVSA aims to democratize access to professional-grade trading tools and education, empowering retail and institutional investors alike.

TradeVSA is a Capital Markets Service License for regulated activity of Investment Advice (“IA”) in relation to Digital Investment Advice (“DIA”). It is also a Malaysia Digital (MD) Company certified by Malaysia Digital Economy Corporation (MDEC) Sdn Bhd.

Media Contact:

TradeVSA System Sdn. Bhd.

Ms. Rianne Chin

rianne@tradevsa.com

6010-266-9761 (Whatsapp Support Only)