In the male-dominated world of fintech, Rianne Chin, CEO of TradeVSA, is leading the charge for change. As one of the few female leaders in the industry, Rianne spearheads the Women in Social Financial Literacy initiative, dedicated to equipping women with essential financial knowledge and tools to take control of their futures. This initiative is helping reshape the financial literacy landscape in Malaysia and promoting a new generation of female leaders in fintech.

A landmark achievement under Rianne’s leadership is TradeVSA’s recognition as the first Malaysia fintech to be granted a Digital Investment Advice (DIA) license by the Securities Commission Malaysia (SC) under Technical Note. 1/2022. This accomplishment not only cements TradeVSA’s position in the fintech space but also opens doors for younger generations, particularly Gen Z and Millennials , to access cutting-edge digital investment advice in Malaysia.

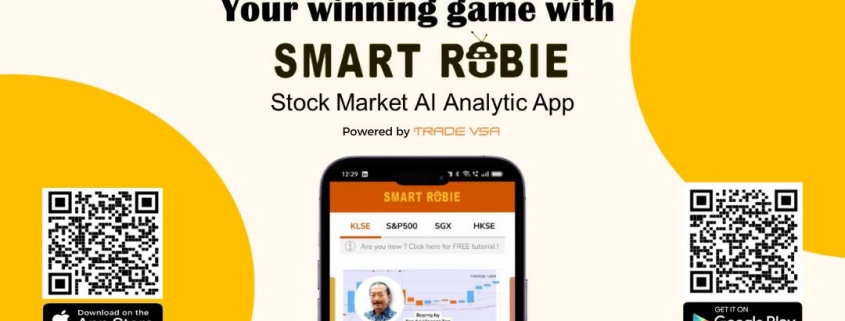

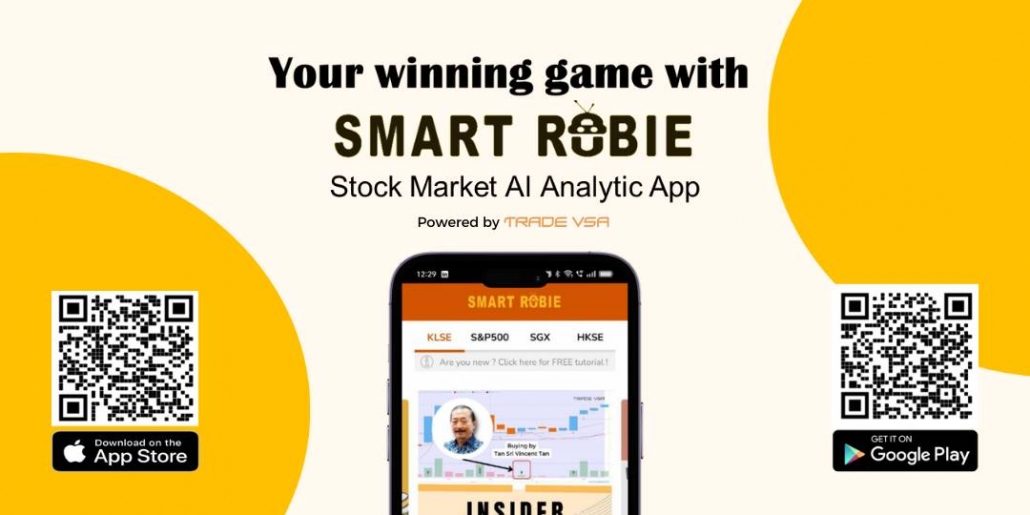

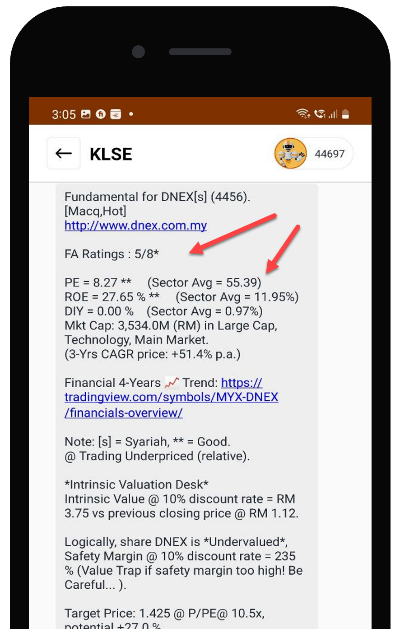

Central to TradeVSA’s innovation is the Algo Pentagon Guider® System , a proprietary technology that powers the SMARTRobie® app , providing digital investment advice to new and seasoned investors alike. This AI-powered platform delivers stock trade ideas with buy call & sell call, watchlist alert for when to buy & sell, and actionable insights, making financial literacy and digital investment advice more accessible to Malaysians. SMARTRobie® is tailored to meet the needs of modern investors, especially younger ones, who seek simplified investment strategies that fit into their digital lifestyles.

Rianne’s leadership isn’t just about breaking glass ceilings—it’s about championing a future where women in fintech are empowered to lead and succeed. Through her dedication to Women in Social Financial Literacy, she’s fostering a movement that encourages financial empowerment for women, supported by robust digital investment advice .

As a Digital Investment Advice provider and fintech leader, Rianne Chin is not only helping investors trade smarter but also paving the way for a more inclusive and financially literate Malaysia. By leveraging platforms like SMARTRobie®, she’s giving both Gen Z and Millennials the tools they need to navigate the stock market with confidence. Through TradeVSA’s digital investment services, Rianne is making it easier for everyone.

Gen Z and Millennials can confidently navigate the world of finance and investments. As the first licensed Digital Investment Advice provider in Malaysia, TradeVSA is revolutionizing the way people interact with the stock market, proving that anyone can trade smarter and take charge of their financial future.

Since Nov 2023, TradeVSA is proud to have been awarded MD (Malaysia Digital) company, a prestigious recognition granted by the Malaysia Digital Economy Corporation (MDEC). This status highlights TradeVSA’s commitment to driving innovation in fintech and digital investment solutions.