Insider buying in Bursa Malaysia

Insider buying in Bursa Malaysia refers to the purchase of shares of a company’s stock by its executives, officers, directors, or other insiders who have access to confidential information about the company. Insider buying is considered to be a bullish sign for a company’s stock, as it indicates that the insiders have confidence in the company’s future prospects and believe that the stock is undervalued. From our TradeVSA research we have seen directors like Tan Sri Vincent Tan Chee Yioun, Tan Sri Lim Wee Chai taking considerable stakes in their own company after disclosing as per regulation CA2016.

In Bursa Malaysia, insider buying is regulated by the Malaysian Securities Commission (SC) and is governed by the Securities Commission Act 1993 and the Code of Corporate Governance. According to the SC, insiders are required to report their dealings in the company’s securities within five days of the transaction. This information is then made publicly available, providing transparency and helping to prevent insider trading.

Here are some the performance likely for these insider buying in KLSE.

- Increased demand will lead to higher prices in futures

- Improved market sentiment by director dealing can improve investor sentiment

- Improved financial performance gives the business owner, stakeholders to take fresh position in their company

How to find them eg. insider buying in Bursa Malaysia.

You can find information about insider buying in Bursa Malaysia by accessing the Bursa Malaysia website. Here are the steps you can follow:

- Go to the Bursa Malaysia website (https://www.bursamalaysia.com/).

- Click on “Market Data” and then “Insider Trades”.

- You will be directed to the Insider Trades page where you can find information about insider buying and selling of securities.

- On this page, you can view the latest insider trades by selecting the date range and security you are interested in.

- The Insider Trades page will show you the insider transactions, including the name of the insider, the security name, the volume of shares bought or sold, and the price per share.

Alternatively, using VSA360 dashboard, you can scan the latest filing by insider buying using TradeVSA special screener. Here is an example of the screen results.

| Stock | Date Change | Name | Unit | Mkt Cap | Industry | Value(RM) | ||

|---|---|---|---|---|---|---|---|---|

| 2023-02-07 | Pavilion Access Sdn Bhd | 99.6 M | 157.4 M | Industrial Products & Services | 38.9 M | |||

| 2023-02-07 | Mr Wong Thean Soon | 5 M | 6.7 B | Technology | 3.5 M | |||

| 2023-02-07 | Inodes Limited | 4.9 M | 3.5 B | Technology | 7.1 M | |||

| 2023-02-07 | Creador Ii, Llc | 4.9 M | 3.5 B | Technology | 7.1 M | |||

| 2023-02-07 | Chow Zee Neng | 1.1 M | 157.4 M | Industrial Products & Services | 447.4 |

It is important to note that while insider buying can be a positive sign, it is not a guarantee of future performance. Other factors, such as market conditions and the company’s financial performance, also play a significant role in determining a stock’s future performance. As such, it is recommended to consider insider buying as one of many factors when evaluating a stock investment in Bursa Malaysia.

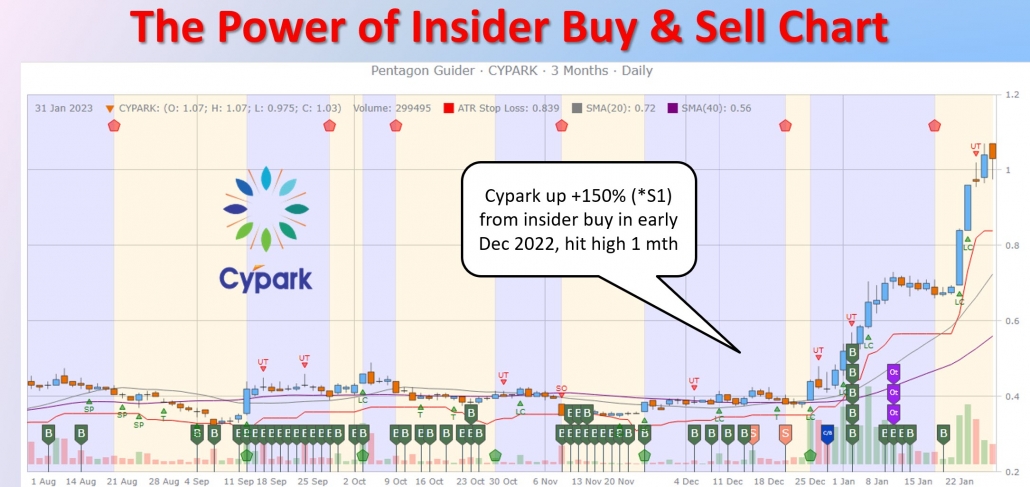

VSA360 also details the filing by insider buying in KLSE using TradeVSA buying and selling guide chart which we believe every trader and investors should have access to them.

The Power of Insider Buy & Sell Chart

To sign up for free 10 days worth RM288 to TradeVSA Dashboard and Insider Buying and selling guide chart, click here.

Or goto https://tradevsa.com/tradevsa-demo-account/